Credit and Debit Cards to be Accepted at GTMs

A TransitLink and UOB Collaboration to promote cashless payment in transit

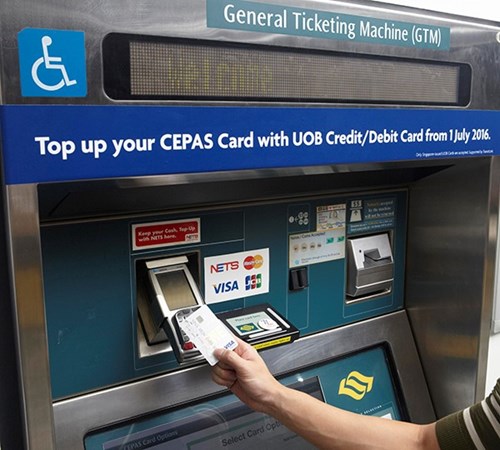

Starting 1 July 2016, commuters will be able to use their credit and debit cards to top up their CEPAS cards at the General Ticketing Machines (GTMs). This new cashless top-up option for CEPAS cards at GTMs across MRT stations island-wide is a collaboration between Transit Link Pte Ltd (TransitLink) and United Overseas Bank (UOB).

2 From 1 July to 31 December 2016, only Singapore-issued UOB Visa, UOB MasterCard and UOB JCB cards will be accepted. Thereafter, from 1 January next year, all foreign- and locally-issued credit and debit cards will be accepted.

![]() Using a UOB credit card to top up at GTM

Using a UOB credit card to top up at GTM

Increasing the Adoption of Cashless Payments in Transit

3 In line with the vision of transforming Singapore into a Smart Nation, embracing the cashless and digital lifestyle, this initiative is aimed at making it easier for commuters to shift from making cash to cashless top-up payments in transit. “With the launch of this new initiative, TransitLink is collaborating with UOB to increase the adoption rate of cashless payments in transit by offering more cashless top-up options for commuters”, said Mr Lee Yuen Hee, Chief Executive Officer, Transit Link Pte Ltd. “The whole idea is to extend the cashless life-style that the public is used to in the retail space to the transit space. This is all part and parcel of our continuous effort to make the transit experience convenient, seamless and an integral part of the commuter’s life-style”, he continued.

4 At present, commuters can already make use of their ATM cards to top up their CEPAS cards. However, total top-up payments made by cash in transit remains high and accounts to nearly 70 per cent of the total top-up value in 2015. About two-thirds of the payments made at the GTMs are cash payments. Through this initiative, it is hoped that cashless top-up payments at GTMs will increase by at least 10 per cent.

Move Towards Contactless Mobile Payment

5 Besides credit and debit cards, more consumers are also using their smartphones to make payments as the mobile phone is increasingly becoming an indispensable part of their life-style. According to the UOB Credit for Transit survey[1], which polled commuters on their payment behavior, over one-third (37 per cent) of the 120 respondents prefer contactless payment options, such as using their mobile wallet or contactless credit cards, to top up their CEPAS cards. Among them, 80 per cent cited the enhanced convenience of tapping with a smartphone or credit card as the key factor.

6 UOB expects that at least one in five UOB card transactions will be a contactless mobile payment and account for 10 per cent of UOB’s entire credit and debit card billings by 2020. In fact, contactless payments made with UOB cards have grown more than 100 per cent year-on-year[2].

7 UOB, as one of Singapore’s top credit card issuers, aims to offer cardmembers more convenient and effortless options to pay. As part of this launch, UOB cardmembers will also be able to make mobile contactless top-up payments at the GTMs via UOB Mighty Pay and Apple Pay.

8 Mr Dennis Khoo, Head of Personal Financial Services Singapore, UOB, said that the exclusive partnership with TransitLink aligns with the Bank’s digitalisation strategy to create seamless touchpoints for its customers to bank and to pay conveniently.

9 “Transit is an integral part of the consumer’s daily life. Our survey showed that nearly half of commuters polled would like contactless payment options when topping up with their credit or debit cards. Through this initiative with TransitLink, UOB customers will be the first in Singapore to enjoy a quicker way to top up by simply tapping their cards, or with their mobile devices, at GTMs island-wide. Expanding contactless acceptance points to the GTMs will further the adoption of such payments and reinforce the move towards a cashless economy,” added Mr Khoo.

Incentivising Commuters to Experience Cashless Top-up Payment

10 Besides enhancing the whole transit experience, commuters can also look forward to earning rebates when they top up their CEPAS card with a UOB credit or debit card over the next six months. UOB Visa and MasterCard cardmembers will be entitled to a S$1 cash rebate for single top-ups worth S$40[3]. Cardmembers will enjoy twice the rebate amount if they top-up through UOB Mighty Pay or Apple Pay.

###

[1] The UOB Transit with Credit Survey is a quantitative face-to-face intercept survey amongst adult public transport commuters aged 18 to 60 years, who use EZ-Link/CEPAS cards for transit payment.

[2] Comparing face-to-face local contactless payment spend for 12 months ending 31 March 2015 vs 12 months ending 31 March 2016.

[3] This cash rebate promotion is limited to one (1) cash rebate per Cardmember per calendar month, for top-ups made between 1 July and 31 December 2016, and is limited to the first 20,000 eligible MasterCard Cardmembers and the first 20,000 eligible Visa Cardmembers on a first-come, first-serve basis.